Table of Content

While compensation arrangements may affect the order, position or placement of product information, it doesn't influence our assessment of those products. Please don't interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don't provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. As of July 2022, Bay Equity Home Loans has a 4.98 out of 5 rating on Zillow from over 8,200 customer reviews. This is both a lot of reviews and a lot of positive reviews for a mortgage lender.

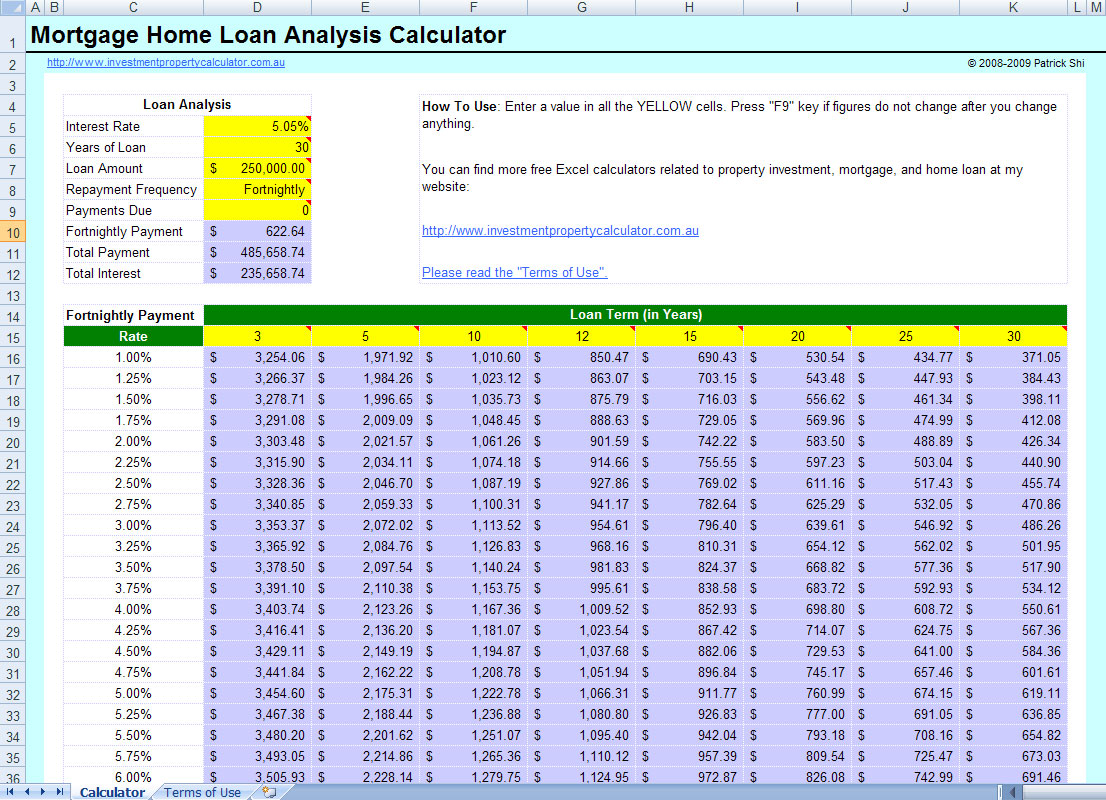

Home Equity doesn’t publish its rates and fees online, which makes it difficult to compare lenders when you’re shopping around. This goes on until at the end of the loan, the principal repayments are almost 100% of the monthly annuity. In other words, your savings component increases, month by month, year by year. Nevertheless, our mortgage calculator is a good start in your search for the best mortgage. In the next step, our financing experts will discuss your financing options with you during a free, no-obligation online consultation, taking into account your situation, wants, and needs. As a rule, your savings must cover the additional purchase costs.

Not sure where to start?

With this information, our financing experts can explain your possible options in detail and provide a free personalized mortgage recommendation. Repayment period Regardless of the interest rate, the faster you repay your mortgage, the lower your financing costs will be, as you will only pay interest on the remaining loan amount. Vice versa, the slower you repay your loan, the higher your financing costs will be. How fast you repay your mortgage loan depends on the amount of your monthly rate and additional repayments you may make. In Germany, most banks offer the option of additional repayments between 5% and a maximum of 10% per year. To find the right mortgage, there are some points you should consider.

Select See rates to provide the lender with basic property and financial details for personalized rates. So if their mortgage rates and lender fees are also solid, they could be a great choice for those looking to finance a home purchase or refinance an existing mortgage. Today, they are one of the largest nonbank, independent mortgage lenders in the country, having funded nearly $5 billion in home loans last year.

Praktikum Equity Sales

We discuss the outcomes and logic of the recommendations with you. You are different from the average customer, sometimes a little and sometimes a lot. Our team of experts will find you the optimal mortgage in Germany online. Global supply chains have faced significant challenges in recent years. In these uncertain times, supply chain finance and digital networks are providing clients with much-needed support. In other words, while experiences can always vary, they seem to be firing on all cylinders when it comes to customer satisfaction.

But we’d like to see Bay Equity be a little more transparent about its rates and fees to make the process easier for homebuyers. Mortgage rates change daily based on market conditions and vary significantly depending on the loan type and the length of the term. Find the best interest rate available to you by getting quotes from three or more mortgage lenders before choosing a home loan. If you’re looking for a similar suite of home loan options and haven’t decided in which state you’ll be purchasing a home, consider Axos Bank. It offers a range of mortgage products and is available nationwide.

Loan types

Though security measures are provided, you may not want to allow access to your online accounts. A HELOC lets you borrow against your home’s equity for debt consolidation and other financial needs. If you want to take advantage of Bay Equity’s same-day approval — a feature that’s not advertised on the website — you should contact a loan officer for more information.

Over at SocialSurvey, it’s the same story – a 4.93-star rating out of 5 from nearly 40,000 customer reviews. The one clue we have about their rates comes from their reviews – on Zillow, many former customers indicated that the rate they received was lower than expected. The move is intended to grow the Redfin Mortgage brand more quickly to serve Redfin real estate agents. Bay Equity Home Loans is a retail, direct-to-consumer mortgage lender that was launched in 2007 by three brothers and a handful of their close friends.

Note that the maximum loan amount you can borrow will also vary depending on the type of mortgage you choose, regardless of the lender you choose. You can refinance mortgages with balances of up to $5,000,000 with Bay Equity Home Loans. Only offers mortgages for multi-family properties, but not for single-family homes or manufactured homes. Another option to narrow down lenders is to use a lending marketplace like Credible or LendingTree.

Recommendation score measures the loyalty between a provider and a consumer. It's at +100 if everybody recommends the provider, and at -100 when no one recommends. By SuperMoney users with a score of -100, equating to 1 on a 5 point rating scale.

However, you also have to accept higher costs, because the longer the fixed interest rate, the higher the interest rate that the bank will call. With a short fixed interest rate period, on the other hand, you benefit from a lower interest rate. But you take a risk as a higher loan balance remains at the end of the fixed interest rate and you may have to take out significantly higher refinancing for it.

However, the homepage doesn’t mention this feature. Fill out the form and click on “Calculate” to see yourestimated monthly payment. To search for loan officers in your state, go to the Bay Equity homepage and type your state name or abbreviation in the search box. This will pull up a list of the branches and loan officers available in your state. Lenders are available in most states across the US.

SuperMoney strives to provide a wide array of offers for our users, but our offers do not represent all financial services companies or products. See if you qualify for student loan refinancing and compare real time offers. This annuity payment consists of both interest and principal repayment. The composition of interest and repayment changes slightly with each month. This is because each repayment reduces the remaining loan balance. Aside from the real estate agent fees, additional purchase costs are usually paid only by the buyer.

In order to get started, you’ll need to head over to the Bay Equity Home Loans website and search their loan officer directory. And there’s a very good chance their 2020 numbers will be even more impressive given the record low mortgage rates that have been available for most of the year. That says a lot about their determination and perseverance, to not only survive that difficult period, but also emerge as one of the largest independent mortgage bankers in the country. Any opinions, analyses, reviews or recommendations expressed here are those of the author’s alone, and have not been reviewed, approved or otherwise endorsed by any financial institution. This editorial content is not provided by any financial institution. Bay Equity Home Loans allows borrowers to apply for loan amounts of up to $5,000,000.

The rule of thumb is that the monthly mortgage payment should not exceed 40% of your net income. This will ensure you have enough money for your living expenses. Under certain conditions, it is also possible to finance a property without equity. These include, for example, a very good credit rating, a very high income, and an excellent location of the property. However, the bank will charge significantly higher interest.

No comments:

Post a Comment